ARGENISIS DECISION SCIENCE SOLUTIONS

Al Intelligence.

Decision systems built for the real world.

We help insurers, health organisations, retailers, educators and other data rich sectors build trustworthy decision systems by combining actuarial science, Al and engineered platforms like GenieAPP, GenieLab, GenieUs and our GenAl ecosystem.

What We Do

High-level on “What We Do.”

AI Intelligence.

Decision systems built for the real world.

We help insurers, health organisations, retailers, educators and other data rich sectors build trustworthy decision systems by combining actuarial science, Al and engineered platforms like GenieAPP, GenieLab, GenieUs and our GenAl ecosystem.

Actuary-founded, delivered by cross-industry AI, data science and engineering teams, with architects and platform builders built for scale and governance. Meet the team →

🟢 Trusted across FTSE 100, London Market & global carriers

🟢 IFoA AI, Data Science & Emerging Technology leadership

What We Do

High-level on “What We Do.”

Trusted By

Some of our client and partner logos.

ARGenesis sits where decision intelligence, deep domain rigour and responsible AI engineering meet. From financial services and insurance to healthcare, education and other high-accountability sectors, these pillars shape how we design platforms, programmes and partnerships.

Our DNA

Three principles behind everything we build.

Rigour-led. AI-enabled.

We start with the decision, the constraints and the stakes then apply analytics, ML, GenAI and automation to deliver outcomes teams can trust.

Built for accountability.

Governance, auditability, privacy, controls and explainability are designed in from day one, so solutions stand up in regulated and risk-critical environments.

Systems that scale.

We build end-to-end decision systems: data → models → workflows → human oversight → measurable improvement. Not one-off models. Operating capability.

What Makes ARGenesis Different

Not just AI experiments — engineered decision systems.

Hybrid expertise

Actuarial, data science, AI engineering and product thinking in one team, anchored by London Market experience.

Governance-first design

Everything we build considers risk, audit, controls and explainability from day one, not as an afterthought.

Platform + consulting

We bring together software, advisory and research, so you get solutions that are both powerful and usable.

Multi-industry impact

Insurance is our core, with growing impact across health, retail, education and wellbeing.

Real results

50%+

Reduction in cycle time.

45 minutes

Pack prep that used to take 3 days

Improved

Return of Investment (RoI)

You can adopt a single component or the full ecosystem. GenieAPP, GenieLab, GenieUs and the GenAI Ecosystem are designed to work together with shared data, patterns and governance.

Our Platform Universe

One integrated decision intelligence ecosystem.

GenieAPP

Actuarial platform (modular)

Reserving · Technical Provisions · Portfolio Intelligence · IFRS 17 · Exposure MI

A modular actuarial platform covering ABE/BEL, Technical Provisions, IFRS 17 support and portfolio / exposure analytics, wired for explainable, GenAI-enabled insight.

Modules can be adopted separately or combined into a single integrated suite.

GenieLab

Orchestration · Agentic workflows · Automation

Workflow and multi-agent orchestration for GenAI and decision automation across underwriting, claims, actuarial and finance with controls, auditability and repeatable patterns.

GenieUs

Co-pilots · Assistants · Apps

Role-based co-pilots and assistants for underwriters, actuaries, claims teams and leadership, delivering task support, insight and guided actions in the flow of work.

GenAI Ecosystem

Platform spine · Shared governance

A coherent GenAI stack connecting data, models, rules, workflows, and user experiences with shared governance, security, evaluation and monitoring across the ecosystem.

Client story

London Market carrier transformation

A major London Market insurer replaced fragmented legacy spreadsheets and reserving tools with GenieAPP. Results included faster cycle times, cleaner audit trails, clearer pricing insight and enhanced leadership visibility.

- Consolidated reserving and pricing into a single governed platform

- Reduced quarter-end narrative prep from 10 days to 3 days

- Improved portfolio transparency for executive and board reporting

- Established repeatable workflows with audit-ready controls

A 60-second introduction to ARGenesis

ARGenesis Introduction

Introduction of how we work in action.

Industries We Serve

Deep roots in insurance, expanding across health, retail and education.

Insurance, Reinsurance, Lloyd’s & MGAs

• Reserving

• Pricing

• Capital & Risk

• Claims

• Underwriting

• Delegated authority

Health & wellbeing

• Mental health

• Clinical ops support

• Wellbeing platforms

• Serenigy ecosystem

Retail & digital

• Customer intelligence

• Personalisation

• Operational AI

• Decision analytics

Education & public sector

• Learning analytics

• Engagement

• Case support

• Policy and consultation insight

Client and partner feedback

What it feels like to work with ARGenesis.

“ARGenesis helped us collapse weeks of reserving and narrative preparation into hours, with governance we could defend.”

Chief Actuary, London Market.

“They bridge actuarial thinking and modern GenAI stacks in a way our teams and regulators could understand.”

Head of Data & Analytics, global insurer.

“ARGenesis embedded our UK cyber pricing model end-to-end, delivering rapid calibration, impact analysis and monitoring, supporting a £620m+ GWP portfolio. Asif’s expertise was pivotal.”

Head of Portfolio Management, London Market.

“ARGenesis advanced Data Science across the IFoA, showcasing high-impact research, delivering standout events and accelerating adoption across actuarial disciplines.”

Global Institute.

Thought leadership

Helping shape how professionals use AI and data.

Chairing the IFoA AI, Data Science & Emerging Technology Practice Board.

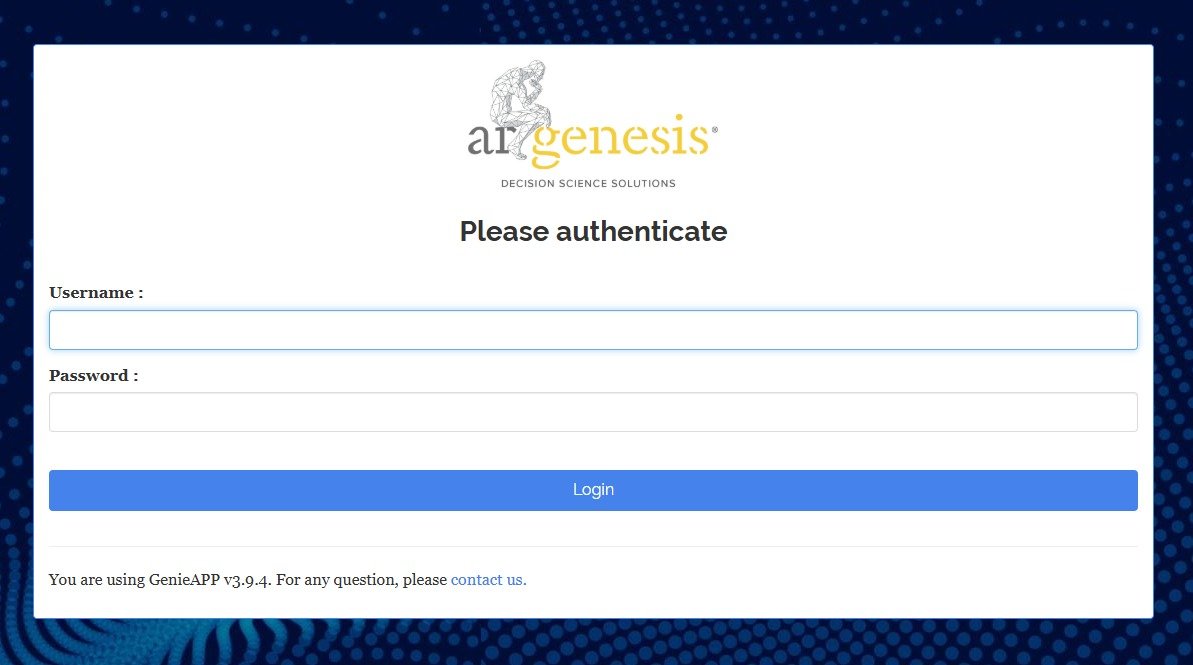

GenieAPP · Flagship Platform

The actuarial engine reimagined.

Built for speed, control & transparency.

GenieAPP is more than a reserving or pricing tool, it is a decision system for insurers. ABE/BEL, technical provisions, portfolio analytics, GenAI insights, governance, reporting and automation all in one engineered environment.

• End-to-end actuarial engine with governance controls

• Reserving, pricing & portfolio insight in one place

• GenAI-enabled interpretation, summaries & audit trails

• Faster decision cycles with explainability

GenieAPP UI preview

GenieAPP Actuarial Platform

Ready for the next step?

Let’s talk about where AI, actuarial and decision systems can take you.

Whether you start with GenieAPP, a GenAI workflow in GenieLab, an underwriting copilot in GenieUs, or a focused consulting engagement, we will meet you where you are and move at a pace that fits your organisation.

ARGenesis AI Intelligence Solution